Cost basis per share calculator

CALCULATOR FOR STOCK SPINOFFS. Percent allocation of cost basis to new spinoff stock for example 2 for 20 7.

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

Our Resources Can Help You Decide Between Taxable Vs.

. How to calculate your cost basis and access cost basis worksheets Using your own records first determine the date you acquired your shares and the cost per share at that. Download Average Down Calculator as an Excel File for free. It covers complex factors like mergers spin-offs voluntary events and.

To calculate the cost of multiple shares purchased simply add the individual cost basis for each share you own. 40 shares costing 18 per share. If you acquired Verizon.

Percent allocation of cost basis to original stock for example 8 for. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. If you refer to the FIFO section above the same sale of 15 shares resulted in a cost.

The total total cost basis for the 15 shares sold would be 10 x 120 5 x 100 or 1700. Cost Basis Average cost. Shares prior to March 20 1998 date of last stock split or through a previous acquisition or merger transaction determining your cost basis is a TWO-STEP.

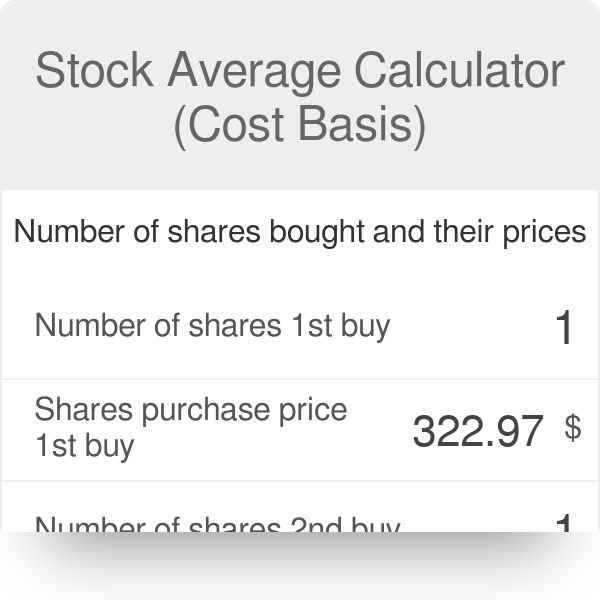

If you acquired your ATT Inc. The Cost Basis Calculator automatically calculates the cost basis and number of shares held for requested securities. To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858.

The Stock Calculator is very simple to use. Lets say you buy 100. Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts.

Enter the number of shares purchased. The cost basis needs to be calculated for each company. For example if you own three shares in the Stock Basis Calculator app and.

Indicate original cost basis per ATT share. Enter the number of shares and price per share for the first purchase and second purchase below. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost.

Just follow the 5 easy steps below. Cost basis per share is the amount you paid for each share after accounting for factors such as dividend reinvestment investment fees and stock splits. Average Cost Calculator for Stocks Cost Basis Calculator The average cost formula is the same if you buy one lot of shares or 20.

Spinoff Calculator for cost basis of spinoff stock received revised basis for original stock and gain or loss on cash received in lieu of fractional shares. Enter the purchase price per share the selling price per share. Select December 31 1983 as your acquisition date.

Free 8 Sample Timesheet Calculator Templates In Pdf Computer Basics Calculator Words Business Template

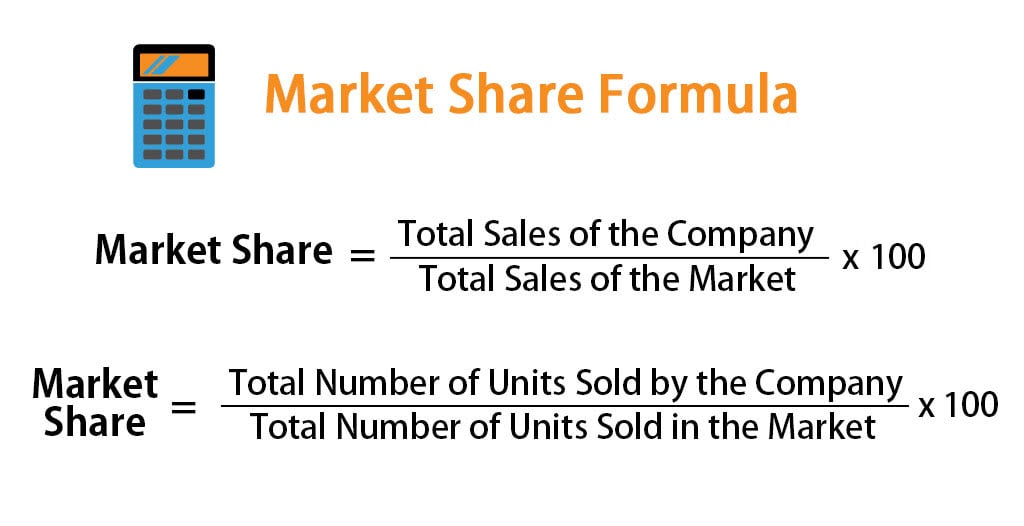

Market Share Formula Calculator Examples With Excel Template

Cost Basis Calculator

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Stock Split Formula And Google Example Calculator Excel Template

Future Value Of An Ordinary Annuity Mgt680 Lecture In Hindi Urdu 25

Stock Average Calculator Cost Basis

Common Stock Formula Calculator Examples With Excel Template

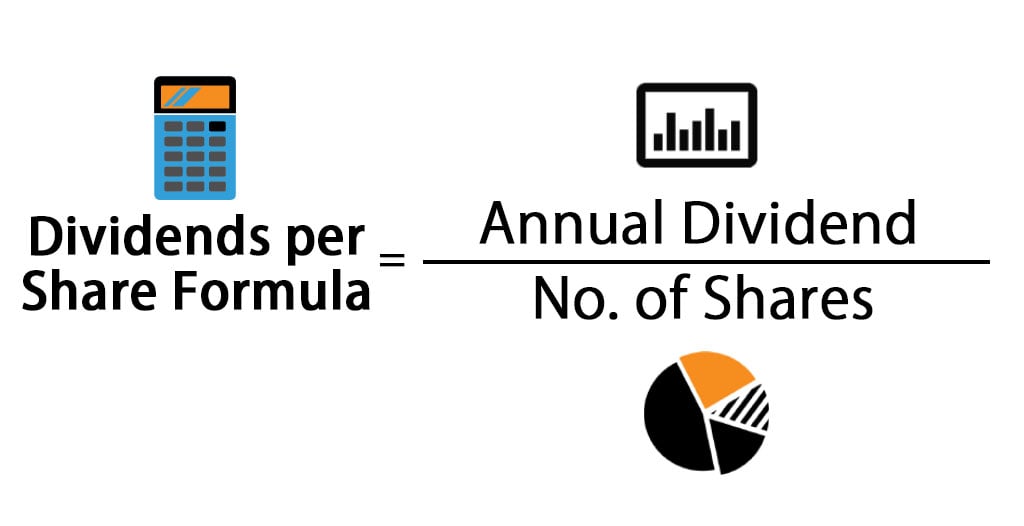

Dividends Per Share Formula Calculator Excel Template

How To Calculate Cost Base Per Share

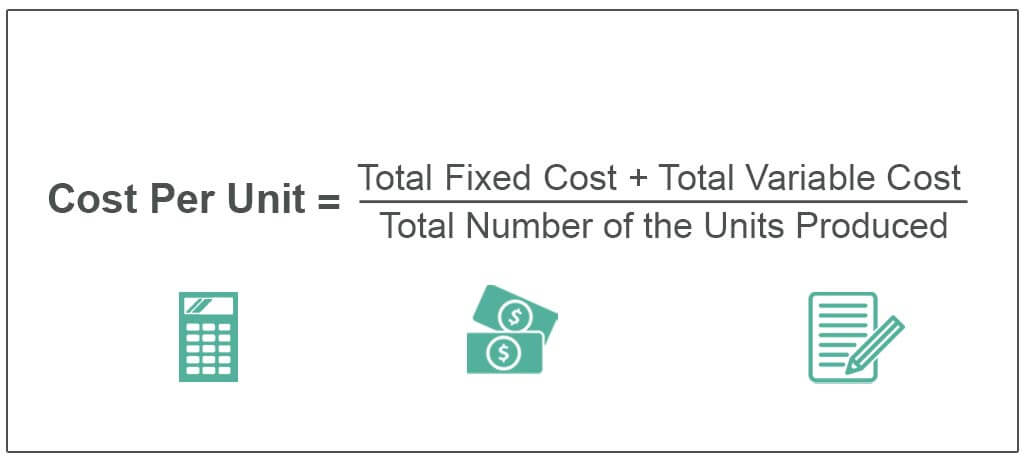

Cost Per Unit Definition Examples How To Calculate

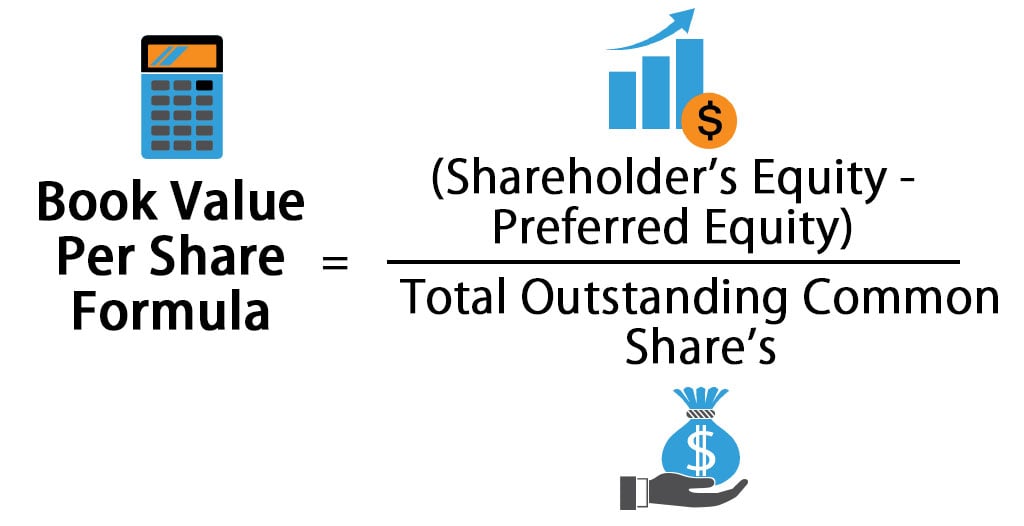

Book Value Per Share Formula Calculator Excel Template

Stock Cost Basis Spreadsheet Spreadsheets Provided Us The Prospective To Input Change And E Planilhas

Stock Average Calculator Cost Basis

Book Value Per Share Bvps Formula And Ratio Calculator Excel Template

Basic Earnings Per Share Eps Formula And Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template